SME IPO – A Catalyst for Wealth Creation

Business Growth Support Advisory By - CA Bhavik Pandit

Business Growth Support Advisory By - CA Bhavik Pandit

MSMEs: The Macro Context

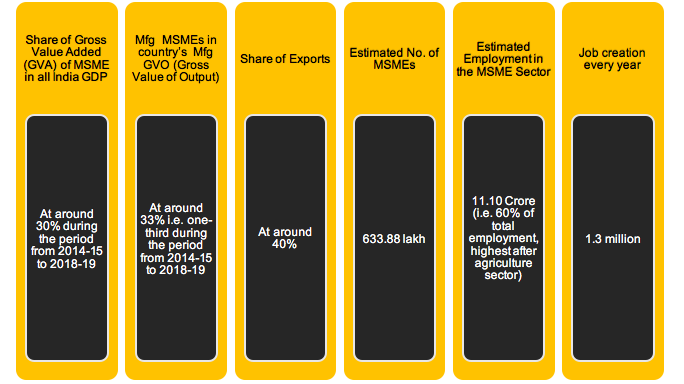

Micro, Small and Medium Enterprises (MSMEs) are an engine of growth for any nation in the world. As per estimates of World Bank, 45% of total employment is created by formal SMEs and approximately up to 33% of national income (GDP) in emerging economies. As per the Annual Report of 2020-21 on MSME Industry, the Micro, Small and Medium Enterprises (MSME) sector has emerged as a highly vibrant and dynamic sector of the Indian economy over the last five decades. Several factors have contributed to this growth – a growing and vibrant business environment and business eco-system, government incentives, expanding geographical markets, funding from banks and financial institutions and most importantly the zeal of Indian entrepreneurs to reach new heights. SMEs have hence emerged as a vibrant and dynamic component of the economy with significant contribution to GDP, industrial production & exports. It contributes significantly in the economic and social development of the country by fostering entrepreneurship and generating large employment opportunities at comparatively lower capital cost, next only to agriculture. MSMEs are complementary to large industries as ancillary units and this sector contributes significantly in the inclusive industrial development of the country. The MSMEs are widening their domain across sectors of the economy, producing diverse range of products and services to meet demands of domestic as well as global markets. An overview and performance of MSME Sector in the country in macro context is as under:

Table 1: Contribution of MSME in Macro Context

Source: Annual Report of 2020-21 on MSME Industry

Micro, Small & Medium Sector has a potential to strengthen the socio-economic growth of the nation by providing solution to the unemployment problem of the country at local and rural level. This will further lessen the inequalities between the geographical areas in terms of economic imbalances. Further, the inclusive pattern of sustainable growth of MSME sector will provide employment opportunities at the local level which will lessen the population load at megacities.

Challenges Faced By MSME:

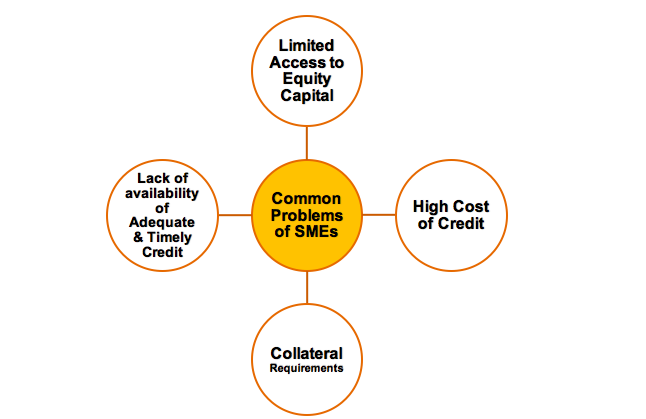

The growth of MSMEs is mainly dependent on the availability of growth capital. Most of the MSMEs require funds / capital to fund the further expansion of facilities, for investment in research and innovations, investment in technology, investment in branding and marketing and such other initiatives. The ability of MSME to expand depends on their capability to raise the funds for investment in these various initiatives. This is the biggest challenge MSMEs face in our Country. Most of the MSMEs rely on the funding from their own sources (own funds and funds from family, relatives and friends) and the debt fund from Financial Institutions, Banks and NBFCs. All these avenues of the funds have their own limitations as availability of funds from own sources is always extremely limited and debt funds comes with extremely high costs and required collateral securities which most of the entrepreneurs do not have. The infusion of capital for growth and expansion of business is extremely difficult for these small and medium businesses and is the biggest impediment to growth.

Reforms to Boost Capital Raising – The Need for an SME Exchange:

The Government and regulators have also recognized this fact that the capital raising is the biggest impediment for MSME. The Prime Minister’s Task Force on Micro, Small and Medium Enterprise appointed under Chairman Mr. T K A Nair, Principal Secretary to Government of India, in its report of January 2010 has noted that “Although Indian MSMEs are a diverse and heterogeneous group, they face some common problems, which are briefly indicated below:

Source: The Prime Minister’s Task Force on Micro, Small and Medium Enterprise

As one of the Legal and Regulatory Recommendation to boost raising of equity, the Task Force has recommended that the “Government should expedite the establishment of a SME Exchange which is already under consideration.”

Prior to the said Task Force, there were attempts to have an SME Exchange. In 1990, Over The Counter Exchange of India – OTCEI was established to provide investors and companies with an additional way to trade and issue securities. It arose primarily from small companies in India finding it difficult to raise capital through mainstream national stock exchanges (BSE / NSE) because they could not fulfil the stringent requirements to be listed on them. In January 2005, BSE launched IndoNext as a platform for the Companies listed on Regional Exchanges to get them listed at BSE to provide wider reach, more liquidity and better reach for capital. However, OTCEI and IndoNext, both were not that successful as they were envisaged. Considering the failure of OTCEI and IndoNext, to provide a platform for raising equity capital, the Market regulator – SEBI permitted the setting up of a dedicated a trading platform for SME.

Introduction of SME Platform

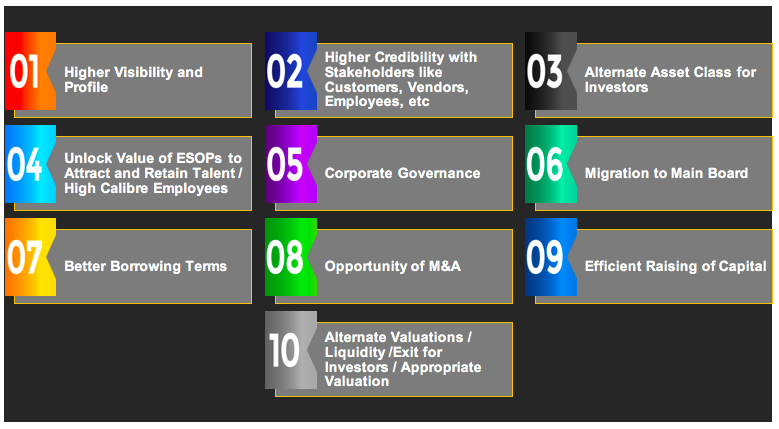

Small and Medium Enterprises (SME) who wish to go public to raise capital and get listed at the Stock Exchange, SEBI has devised an IPO (Initial Public Offer) route exclusively for SME’s where the SMEs can raise funds from capital market. The IPO is one of the means of financing and it is an important residuary method to raise funds for any corporate which are aspiring for growth. To facilitate the access to capital markets easily, improved credibility and visibility locally as well as internationally, a dedicated stock exchange platforms are set up in the form of BSE SME and NSE Emerge in India. These are exclusive platforms for growing SMEs to approach capital markets as a new and viable alternative for raising capital in an efficient manner and for other value propositions such as:

Benefits of Listing:

The benefits of listing are immense. Listed equity is the best tool to fetch right value of the business enterprise as a going concern. IT results in to wealth creation for its stakeholders. Companies like Infosys, Reliance which started as an SME are the example of the wealth creation. If we have to summarise the benefits of the listing, the same can be as under:

SMEs’ Potential for SME IPO: `

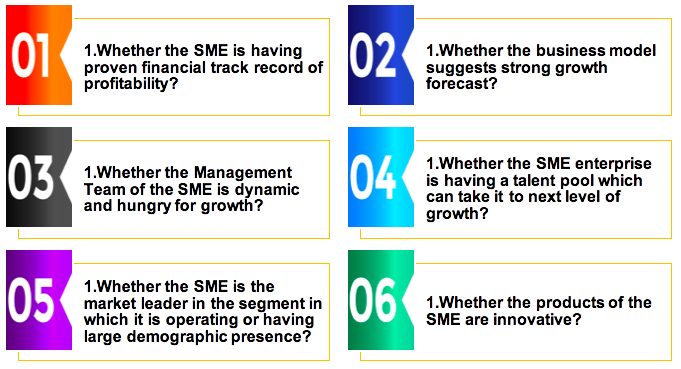

The question is which type of SMEs should access the SME platform to raise capital and get listed. For this, there are the eligibility criteria defined by BSE SME and NSE Emerge and the SMEs which are eligible as per these criteria can raise capital through IPO. The much broader question asked is though as an SME, if an enterprise is qualifying / eligible for the SME IPO / Listing, whether it should opt for it or not. To get an answer to this question, any SME entrepreneur should ask following questions.

If the answer to this questions is “yes”, the SME Enterprise is a fit case for SME IPO. This test is necessary as there are many SMEs which are eligible as per the defined criteria but the answer to most of the above questions is “no”. In such case, though eligible, such SME Enterprise will fail to create business value and wealth thru IPO and listing and the process of listing will become a costly affair.

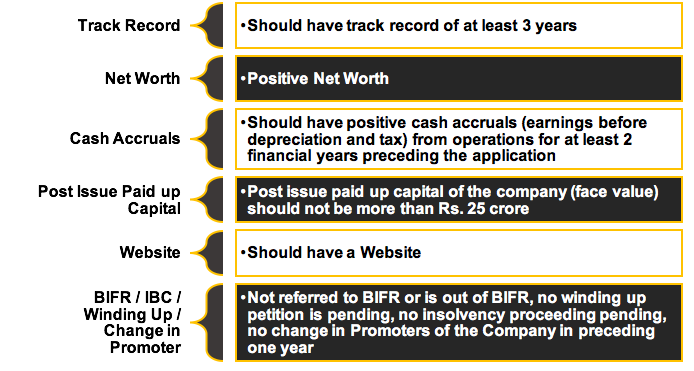

Eligibility Criteria for listing on SME Platform

Under the guidelines of SEBI, BSE SME and NSE Emerge have stipulated the eligibility criteria for SMEs for raising capital through SME Platform and get listed. The brief summary of these criteria is in the table given hereunder.

Table 2: Eligibility Criteria for listing on SME Platform

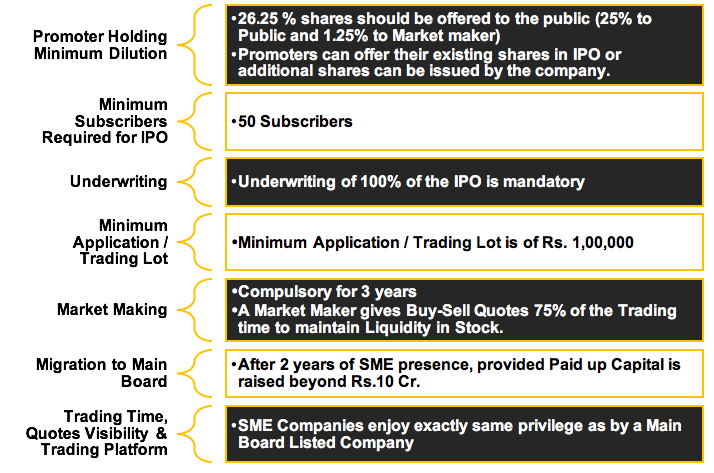

SME IPO – Other Important Stipulations:

There are certain other important provisions which the SME Entrepreneur should understand while deciding for the SME Platform IPO. Pre-issue capital structure and post-issue capital structure, minimum required dilution of Promoters’ holding, Market Making and such other stipulations are very important for an Entrepreneur and he needs to understand these well. These important facts are given in the table hereunder.

Table 3: Other Important Provisions about IPO and listing on SME Platform

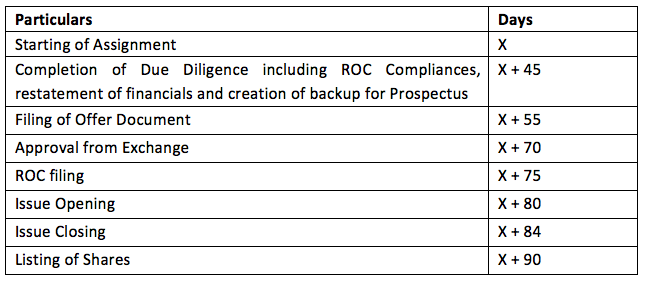

Listing Activity Timeline and Process:

The SME Entrepreneur need to understand the process for the listing properly. Once the eligibility criteria, other statutory provisions are understood and also the internal check on potential for SME IPO is carried out with the positive outcome, the SME IPO is a matter of a process to be carried out by the Merchant Banker. Hence the process incepts with the first step of appointing an advisor who is a Merchant Banker. The process needs lot od planning, documentation, due diligence, filing of draft prospectus with Stock Exchange / ROC and issue opening and closing finally resulting in to the listing. The steps of process / tentative activity chart of SME IPO / Listing represented hereunder:

SME Listing process is shorter and time efficient as compared to the main board IPO / Listing. The tentative time chart for completion of SME-IPO is as under:

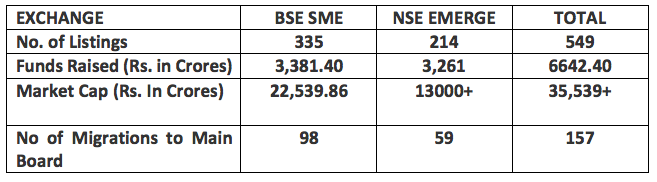

SME IPO – Present Scenario:

Two main board exchanges of the Country, i.e. NSE and BSE both have launched SME Platform in March 2012 as NSE Emerge and BSESME respectively. Till date total 549 SME Companies have got themselves listed on these platforms. Out of these 549 Companies, 157 SME Companies have migrated to the main board exchange i.e. NSE and BSE. The brief details of the statistics of the SME listed companies is as under:

BSE SME has also launched S&P BSE SME IPO Index in December 2012 with the base value of 100. The Index closed at 1,793.92 on 16th April 2021. The chart showing the journey of the Index is produced hereunder:

Conclusion

Considering the present scenario, wherein, till date 549 SME Companies have got them listed at BSE SME or NSE Emerge and have raised 6,642.40 crore as equity capital. Out of these 549 SME Enterprises, 157 SMEs have already migrated to the Main Board Exchange of BSE or NSE. The market capitalisation as on date of SME listed entity is Rs. Rs. 35,539+ crore. These figures suggests that SME Exchanges have witnessed strong momentum. However, for SME listing, it is necessary to attract more retail and institutional investors. As compared to main board IPO, the participation of retail investors is minimal in the SME IPO. There are certain barriers which needs to be addressed by the regulators. The biggest barrier is the minimum application money / trading lot of Rs. 1,00,000. This restricts the participation of the retail investors and also reduces the liquidity at the SME Platform. Also, there are many potential SMEs which can become wealth creator like Infosys or Reliance provided that the knowledge ecosystem is available for these SMEs and the barriers to sources of financing for SMEs are removed. A cohesive approach by the Regulators like SEBI / NSE / BSE, Ministry of MSME, Ministry of Finance / Corporate Affairs, Various Trade, Commerce and Industrial Associations representing MSMEs, IPO Intermediaries like Consultants, Merchant Bankers and others is a need of the time to enhance awareness among the SME Entrepreneurs and retail investors and strengthening the ecosystem of capital for SMEs. Considering the Government’s push for “Atma Nirbhar Bharat”, the need of the capital required for growth can be addressed through SME IPO / Listing. SME IPO / Listing definitely has a huge role in the growth ecosystem to address the need of capital.

To create awareness among SME and develop a knowledge ecosystem for SME IPO, the SME Growth Consultant, Merchant Banker / Lead Manager have a huge role as they are the pivotal to the entire exercise. Their role in managing the entire process of SME IPO is well depicted hereunder.

With combined efforts of all to create and develop the growth ecosystem for SME, capital flows from SME IPO towards emerging companies will add much needed impetus to the growth story of India as these emerging SME enterprises have the promise and the zeal to take India on to this growth trajectory.

For any assistance or guidance or query related to SME IPO and SME Listing, please write us at info@sharmaandpagaria.com

CA Bhavik Pandit

Partner, Sharma & Pagaria, Chartered Accountants, Bengaluru.

Blog Disclaimer: “All information contained herewith is provided for reference purpose only. Sharma & Pagaria, Chartered Accountants (S&P CA) ensures accuracy and reliability of the information to the best of its endeavours. While the information contained within this Blog is updated, no guarantee is given that the information provided in this Blog is correct, complete, and up to date. S&P CA makes no warranty or representation as to the accuracy, completeness, or reliability of any of the information contained herein and disclaim any and all liability whatsoever to any person for any damage or loss of any nature arising from or as a result of reliance on any of the information provided herein. The information contained in this Blog is not intended to provide any professional advice.